When you are facing a Debt-Crisis, your constant focus is on the situation, so when you are rather opting to focus on this, you are feeding it, so it grows, until it consumes you and is totally out of control.

In the interim, in all this mayhem, you forgot to take a few steps back, review the situation and ask yourself “How much am I really worth? Is it not worth it to invest in myself, my own well-being and Debt-Recovery?

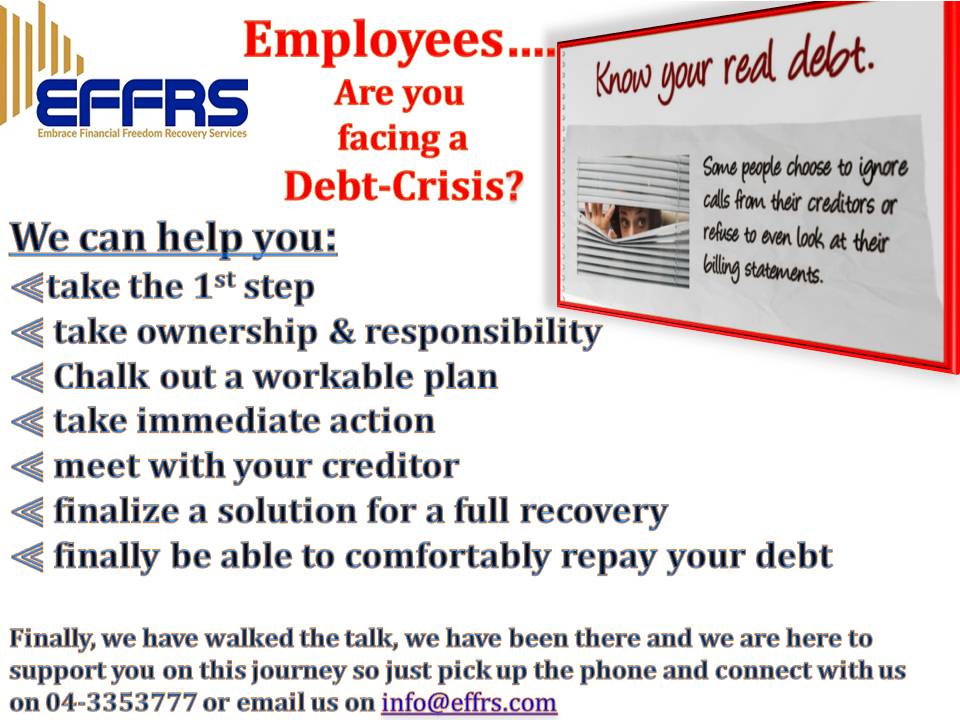

OR; do you just ignore the situation and proceed with your normal bad habits that resulted in you facing a Debt-Crisis, or simply just live past, because now you are holding whatever money you have to yourself and therefore unknowingly creating ‘Limiting Beliefs’. So guess what? Whatever you are holding in your hand, is all it will ever amount to, nothing more and then you wonder:

a. Why is this happening to me?

b. Why am I stuck?

c. Why is everything coming onto my head at the same time?

Next, anxiety, depression, emotional fear, no zest for life, wanting to throw in the towel and all these negative emotions start consuming your entire being.

But the irony is, you would much rather go off on a weekend and spend more money you don’t have, or do a desperate bout of shopping because it’s your habit and continue spending money that you don’t have…

Remember…..That’s how you became reckless with money in the first place, even taking loans and credit cards, mean’t you had so much money to spend that you had not earned yet, that was not even your own hard earned money and realism is, you must repay the money, refuting ownership and responsibility to show that willingness to your creditors, blaming them for high interest, penalties applied, etc…when you signed the original application with the knowledge that it must be repaid, as per the creditors policies, now appears to be a lame excuse. You are refuting to take responsibility, which in turns means you’re sowing bad seed, so you can only reap bad and debt does not distinguish between anyone, it takes you when it wants you, most times, to teach you a lesson.

A new page means making a concerted decision to invest in yourself, your own well-being, by consulting with your creditor or a reputable remedial company who can fully support you. This is for sure not money lost, if you know whom you are dealing with. However, we are not prone to investing in ourselves, especially if the ‘goods you are purchasing’, which in this instance is a service, so it is perceived to be intangible. Relealize not everyone is operating like a shop on the corner, many are creating huge value by collaboration, rendering sterling services and supporting to transform lives and put people onto a Debt Recovery Path.

My personal experience is that people need to learn to be Grateful, say Thanks when it is necessary and stop beating the old stories that will continue to suppress them, time to turn a new leave, grab that new life that is waiting for you and walk away from the past, but do the right thing!

Gratitude, Appreciation and Thanks will transform your life without you even realizing it! You cannot create new with old, period!