Over the past month, there has been a visible improvement of UAE Debtors approaches to seek Remedial Support for their overdue outstanding liabilities, whether still in the country, or skipped/exited out of the country.

This is an excellent sign of progress, when Debtors are taking ownership and responsibility for their UAE liabilities, where many have shared that they wish to return.

I guess that when facing a Debt-Crisis, it gives you a tough lesson and once you exit for example, you understand once you arrive on the other side and sit it out for months, if not years, that the grass is never greener on the other side, especially if you have resided in the UAE for years or decades.

Our philosophy as experienced Expatriates resident in the UAE for almost 2 decades is that, “The Power of Money is in the UAE and it will remain here”, where you will only find this out the hard way. There is no other country in the world where you can rebuild and recover within a short period, versus in your home country and we understand this, because when we exit to our home countries, we find that we start living in a dire lack, that money does not flow that easily and one key lesson you need to realize is that running from anything, does not make you free, in fact it adds loads of years on your life, because you end up spending it ‘watching your back’, that a Creditor may just manage to locate you to pay your dues, leaving you in a worse situation, as you have no more money by this stage.

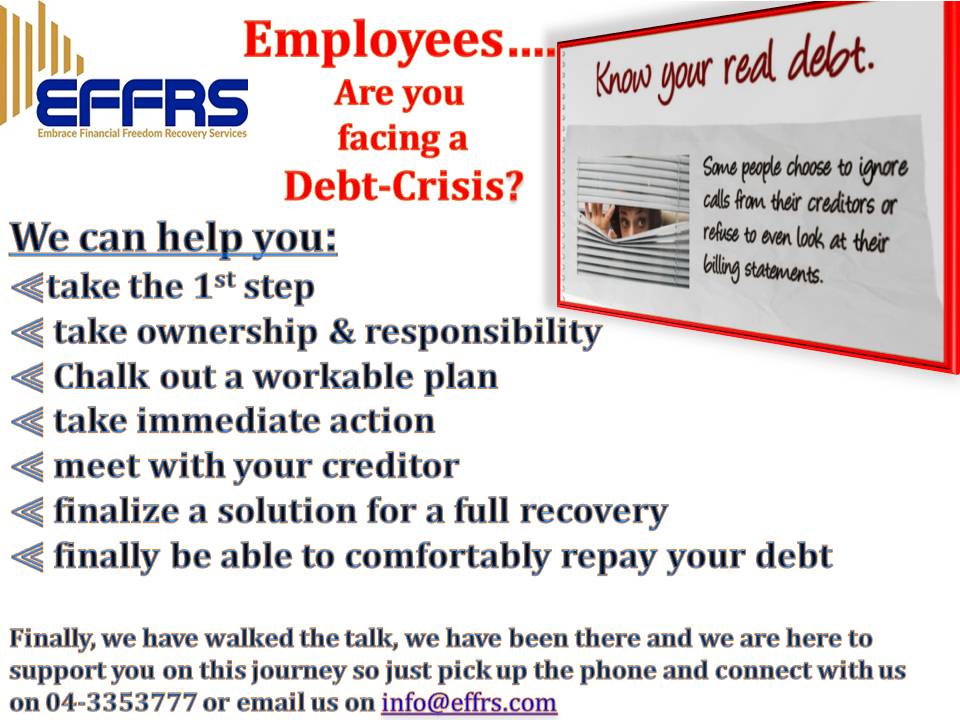

Hence, it is very refreshing to see the Debtor reach almost on a daily basis, where you need to understand that there is a solution for everyone facing a Debt-Crisis, because anything is negotiable with the ability for new Settlement Plans or Restructures, you must just be willing to take this ownership and responsibility, to make the right decision to free yourself from these liabilities that continue to weigh you down emotionally, because its very hard to cope with those emotions.

We also understand the ‘Trust Factor”, of entrusting your liability Settlement Plans with a company you have no experience with, but the consolation is that we insist upon securing a new Settlement Plan or Restructure for you, that you directly deposit or transfer these payments and/or EMI’s into your Creditor account, alleviating any future problems.

We are fortunate that to date, we have established a sound reputation of credibility and trust with our Clients and Creditor Partners, which we treasure and nurture for the next years, to bring the best to the table for all Parties.

We urge you if you are a private individual or company owner with this struggle, then contact us today, all confidentiality assured, as we operate with the highest degree of integrity.

Thank you